POS Blog

Insight on POS Solution Selection for Independent Merchants

POS Implementation

Helpful hints from industry experts on best practices for implementing POS solutions.

- Subscribe to this category

- Subscribe via RSS

- 4 posts in this category

Paper or Plastic? Payment Processing Considerations from an Objective Source

Chances are you are not carrying as much cash as you did in the past. You are not alone. According to the Federal Reserve Bank of Boston, there were some 176.8 Million Card Holders in 2010. Further, the average cardholder carries 3.5 cards. 80% of all consumers carry a debit card. Approximately 60% of all consumers have a rewards card of some kind. That is a lot of plastic!

Many factors contribute to the paper VS plastic ratios in the payments world including convenience, loyalty point and rewards programs, speed of check-out, security, etc. So, as a merchant, it is absolutely necessary in this day and age to accept as many forms of payment as possible. Hence, you need to select a merchant service provider. So, what are the things you should consider? Where do you begin?

I have never been in the business of payment processing. However, spending the last thirteen years of my career in the point-of-sale software business, I have learned quite a bit about the payment processing industry. To provide a complete POS solution, we must be able to provide payment processing options that are seamlessly integrated with our software. Consequently, I have spent a great deal of time working with companies in the payments industry and learning how it all works.

The world of payment processing is complex for a number of reasons. Security and fraud protection is key. There are lots of people involved and lots of technology that comes into play with each and every transaction. You most likely receive calls from payment processing companies several times a week. They want your business and they promise differentiators from the last 500 companies that called you. All you want is to accept credit cards and pay the lowest rate possible. Right? So, what other considerations are there?

Here are a few pointers from a semi-educated and unbiased point of view:

1. Eliminate as many layers as possible. There can be lots of layers in payment processing. There are ISO’s, gateways, software companies, processors, acquiring banks, card issuers, etc. With each layer comes potential points of failure and often times additional costs. So, focus on buying direct as much as you can. Sometimes, bigger is better. This may be one of those times.

2. Be sure that your payment processing selection is compatible with your POS software and hardware. Many of these providers use proprietary systems and devices that may or may not work with your POS. If the payment processing is not fully integrated, you could spend hours on reconciliation each day and significantly decrease your speed of service.

3. Seek clear and concise pricing models and transparent merchant account statements. If the company does not provide full transparency, it is difficult to decipher what you are actually paying to process transactions. That is typically by design and means there are hidden fees along the way. Ask for “interchange plus” pricing.

4. Avoid long-term contracts and cancellation fees. In today’s climate, you never know what tomorrow brings. New security standards are just around every bend. Less expensive options may be as well. You might switch your business model or upgrade your POS system. Who knows? It is best to be free of long-term obligations with payment processors just in case changes occur.

The acceptance of electronic payments can be expensive. However, I have a customer who has a much different view. This customer has a goal to go 100% plastic in the very near future. He loves accepting credit cards for a few reasons:

1. With 1-second approvals, it is faster than cash.

2. His employees and managers spend several hours a week reconciling cash drawers.

3. He sends employees to the bank in the inner city several times a week with large amounts of cash.

In his mind, electronic payments are the way to go. They speed up service, free up employees to take care of customers and decrease his liability with the banking issue. When I asked him what he planned to do when cash-carrying customers grew angry over the new cashless system, his answer was a great one. He said that it would only happen once. He would pay for their lunch and gain a customer for life.

POS Implementation Guide Featured

Most merchants go through a detailed process to select the right POS (point-of-sale) solution for their business. There are several factors to consider which we discuss in our POS Solution Selection Checklist and our POS Selection Guide. These factors vary in level of importance from one market segment to another. Once that decision process comes to a close and the POS selection has been made, the merchant is faced with the POS implementation process. Most of the challenges and issues involved with the implementation process are consistent among the different market segments. The POS implementation process is critical to the success of the POS deployment.

So, what can a merchant do to ensure a successful deployment of the new POS system to protect the investment? There are several issues to consider and tasks to complete by both the POS solution provider and the merchant prior to the first live transaction processing through the new POS. Below are just a few critical items that require attention and cooperation between the solution provider and the merchant.

1. Hardware – Whether purchasing all new hardware or salvaging hardware from previous systems, it is critical that all hardware used in the deployment is compatible with all the new POS software. Nothing is more frustrating than struggling through compatibility issues when rolling out a new POS solution. Vendors and merchants must work together to ensure that every last detailed requirement is met from a hardware perspective prior to installing new POS software.

2. IT Infrastructure – Similar to hardware, proper networking components and topology are critical to the success of a POS solution deployment. POS systems handle sensitive data that must be secured. POS systems are mission-critical in retail and hospitality environments so network connectivity can be key to the successful operation of the POS on a daily basis.

3. Data – With POS data, a few factors come into play during a new POS solution deployment. First of all, data must be converted from previous systems to avoid countless hours of typing just to get the new POS off the ground. When converting from a cash register to an automated POS system, data can be gathered from the merchant’s suppliers to be massaged and converted into the database format of the new POS system. Configuration of a data backup and disaster recovery plan also needs to be part of every POS deployment. The POS data is the only component of the POS solution that is truly unique to the merchant and cannot be easily replaced in the event of a disaster.

4. Integration to Existing Systems – Prior to launching a new POS system, it is critical that seamless integration is provided to existing systems that will continue to be in use by the merchant. For example, be sure the new POS system will integrate smoothly with the back office accounting package in place and the merchant services/payment processing systems in place.

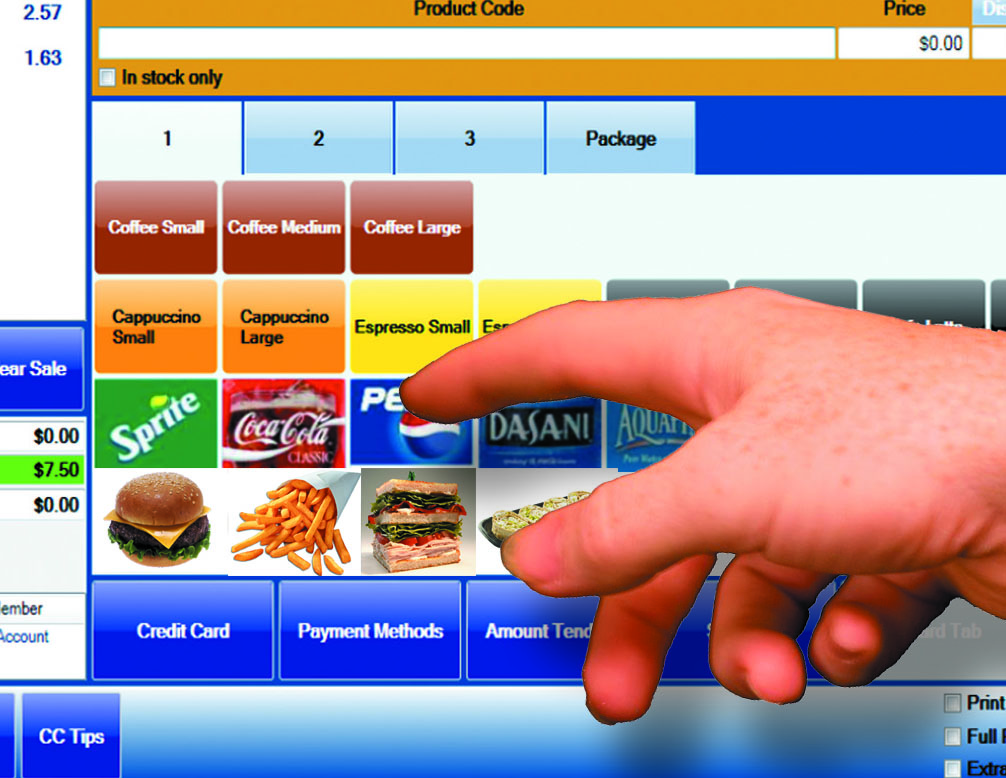

5. Adequate Training – End user training is arguably the most important factor in a successful POS deployment. Typically, owners and managers are trained to be “site experts” on the new POS solution. This allows them to be somewhat self-sufficient moving forward so that ongoing training from the POS solution provider becomes less necessary. As new employees come onboard with the merchant, owners and managers need to have all the knowledge and tools necessary to teach employees proficiency in the operation of the new POS system.

Protect your POS investment by focusing the required time and energy into the implementation process. After all, a great deal of time, energy and money are normally put into the POS solution selection process. It doesn’t stop there. The POS deployment project must be carefully planned and executed to ensure the success of the project. For more information on issues to consider when deploying a new POS solution, download our free guide today.

Multi-Site Merchant POS Solutions Featured

Multi-site merchants are faced with numerous challenges. This is why the franchising model continues to grow in its success. However, many independent business owners continue to operate multiple locations without going out to the franchise market. Obviously, it is impossible to be in more than one place at the same time. So, owners must build a solid and trustworthy team of people around them to ensure profitability.

In addition to the team of people, owners can utilize powerful technology tools that reduce the desire to be in several places at once. For merchants, the POS (point-of-sale) system deployed in their storefronts is typically at the core of the technology infrastructure of their business. The POS system automates many functions that drive the success of the business. The POS solution manages inventory, payment processing, invoicing, gift and loyalty programs, customer relationships, targeted marketing, etc. All of these items become more complex when spread across multiple locations owned by the same entity.

Below are a few critical factors in the successful deployment of a multi-site POS solution:

1. Everything must happen in real time. In this day and age of constant connectivity and sophisticated data centers, there is no reason a merchant should have to wait for a batch synchronization of data. Aside from the unnecessary wait time, data synchronization contains too many moving parts that create potential points of failure. These points of failure lead to headaches for the merchant.

2. The POS must be scalable with no limitations. Multi-site owners are successful and will continue to grow the business. There should be no technological limitations to the number of locations to add to the POS deployment.

3. The POS solution should perform the same as it does for a single site deployment. Often times, POS providers will shift the application to a browser-based model if the merchant owns multiple locations. The browser is great for Facebook and online banking. However, it is difficult to build a POS solution that is robust and user-friendly within the framework of a web browser.

4. The POS rollout should be simple. Adding additional locations to a POS deployment should require very little configuration changes, minimal set-up tasks and no training. It should be a flip of a switch to add on additional sites.

5. The POS investment should be scaled. In other words, the merchant should not have to purchase the solution over and over as locations are added. The pricing should be scaled in such a way that the investment required in the POS as locations are added is less than the original purchase.

Robust POS solutions provide multi-site operators with powerful tools to operate all locations from one place. For other items to consider when seeking POS solutions, download our free selection guide today.

The Importance of POS data backups Featured

The Importance of POS data backups

After visiting with a few customers in recent weeks, I am reminded of the importance of backing up POS data. Independent merchants often lose sight of the importance of this concept. Often times, it is a simple case of “out of sight – out of mind.” Other times, merchants assume that their POS provider is taking care of these tasks for them. Although this may be the case in some instances, it is critical that independent merchants understand the importance of backing up the POS data as how it works, where the backup resides, etc.

POS systems are deployed in a variety of ways. The architecture of the POS software as well as the database platform used can sometimes determine how the POS solution is deployed. Other factors are the number of sites involved, ownership structure, hardware in place, etc. One primary consideration is whether the POS data resides at the merchant’s facility or in an off-site data center. As far as POS data backups are concerned, the systems that are deployed with data residing at the merchant’s site are typically the most suspect to failure in the database backup and disaster recovery concept. Although this “localized” model is common with POS deployment, these merchants need to be the most cautious with the backup and recovery plan.

Receipt printers can be replaced quickly. Touch screens and cash drawers can be replaced easily. Even PC’s, touch terminals and POS software are fairly easy to replace in the entire scheme of things. The one and only item that absolutely cannot be replaced for a merchant in the event of a disaster is the POS data. The POS data is the only portion of your POS system that is unique to the merchant and cannot be replaced by the POS solution provider. When a storm like Hurricane Sandy causes widespread damage, merchants need to be reminded of this and take action immediately. All the bottled water and toilet paper in the world will not recover your POS data in the event of a disaster.

A few points to consider:

1. If your POS data resides in a data center (the cloud), there should be enough redundancy built in to recover from just about any disaster. However, it is better to be safe than sorry. Find out what type of redundancy is in place and how quickly data can be restored is something terrible should happen. Do you have anything in writing? If it is way over your head, do you have an IT consultant who can understand it and explain it to you or work with the data center on your behalf?

2. If your POS data resides at your facility, are you making frequent backups? If it is supposedly happening automatically, do you check to verify that it is happening at the scheduled time or is it simply out of sight – out of mind?

3. Do you remove a copy of your POS data backup from the site on a regular basis? If your building burns to the ground, your data backups won’t do you much good if they are inside that building.

4. Do you know the process for restoring your POS data? Do you know how long it takes? If you have a solid support agreement with your POS provider, you may not need to worry about this. If you don’t have a support agreement in place, it is critical that you find out how to restore from a backup.

With decades of experience as a POS solution provider, we have seen our fair share of disasters in this area. Don’t allow yourself to become the next statistic. Protect your POS data in every way that you can. Our best recommendation is to partner with a company who specializes in off-site backup and recovery systems. This will usually take the entire process completely out of your hands. If you need help with this, we can provide some recommendations for reputable companies who provide these types of services at affordable prices. By the way, just like anything else, the cheapest backup program is typically not the best backup program. Be careful to make sure the program you select supports the database platform of your POS system and also guarantees a speedy recovery in the event of a disaster.

If you have any questions in regard to POS data backups or any other POS deployment concerns, feel free to contact us directly at [email protected].